The Next Ronald Reagan Is The Leader Who Rediscovers Something Very Basic

Comment Now

Follow Comments

So let’s see where we are with a large and crucial sector of the American economy. Costs in this sector have been soaring for most of the previous decade, depressing income growth and significantly harming the overall economy. The industry is unpopular with the American public, except when its products are needed. After months of secret planning sessions by “expert” insiders, the new president proposes to Congress an ambitious, 2,000-page plan to solve the problem that involves a complicated scheme of incentives, state-federal regulatory realignment, new taxes, mandates, subsidies, and standby powers for rationing.

Obamacare in 2009? No: this describes Jimmy Carter’s proposed energy plan of 1977 to solve the “energy crisis” of that decade. But unlike Obamacare, only a few aspects of Carter’s grand scheme ever made it out of Congress; most of them were stupid or irrelevant, though they paved the way for many of the renewable energy mandates and subsidies that continue to plague our energy sector today.

There’s a lot to be learned from the parallels between the “energy crisis” of the 1970s and health care today. The two domains are not identical, but there are many similarities. As with health care today, the energy marketplace of that time was badly distorted by a patchwork of federal and state controls that stifled supply and innovation and prevented markets from correcting shortages and wasteful use. There were lots of myths and conspiracy theories about how the energy industry operated, and there was strong support on the Left (which still exists today) to nationalize much of the industry, just like health care.

It turned out that the solution to the purported “energy crisis” was simple, and could be stated in one word: de-regulation. Even Jimmy Carter started to figure this out by the end of this hapless presidency, taking the first halting steps to de-control the price of oil and natural gas. Ronald Reagan decided there was no good reason for half-measures and delay, and fully decontrolled the price of oil on his first day in office.

Liberals reacted with horror, predicting the price of gasoline—then about $1.40 a gallon—would soar. Sen. Don Riegle of Michigan said that “It will hurt our people within a matter of days.” Sen. Dale Bumpers of Arkansas predicted that “without rationing, gasoline will soon go to $3 a gallon.” Congressman (now Senator) Ed Markey said “I believe that decontrol as a cure will prove to be worse than the disease of oil addiction.” Sen. George Mitchell said “Every citizen and every family will find their living standards reduced by this decision.” What actually happened? Sure enough, oil prices started falling immediately, with gasoline drifting down to 89 cents a gallon by 1986. The liberal prophecies disappeared down a memory hole.

There is a broader point to be taken from this history lesson. It is usually a sound principle to survey what liberals predict about any subject, and then expect the opposite. It didn’t take any special insight to know that promises of lower costs from Obamacare would turn out to be disastrously wrong.

But the perennial failures of liberalism are insufficient to assure the triumph of market alternatives. Margaret Thatcher was surely right to say “the facts of life are conservative,” but this does not mean conservatism is self-executing. (Or as M. Stanton Evans likes to say, “Conservatism is not spread by casual contact.”) The case for de-controlled markets requires constant persuasion and example. Ronald Reagan accompanied his decontrol of energy markets (and other markets as well) with persistent argumentation and public persuasion. He would surely be astonished that, more than 20 years after the Cold War ended and the supposed vindication of open markets swept the globe, we would be in the midst of nationalizing health care, re-regulating finance in destructive ways, and actively contemplating a return to dirigisme energy policy.

Defenders of the true classical liberal order need to step back and take stock, beginning with the question: how did we arrive at this current pass? The fault lies partly with ourselves. The defenders of liberty became complacent in the aftermath of the Cold War, and forgot that the Left’s drive for political control is relentless and protean. We stopped arguing the first principles of liberty, in part beguiled by the partial concessions to our point of view from neoliberals like Bill Clinton and Tony Blair.

Careful students of events know that the purported “market failures” of health care, the housing bubble, Wall Street, and electricity (recall California and its rolling blackouts back around 2000, blamed on Enron rather than inept restructuring) should really be attributed to government failure and perverse regulation. But most of the public are not careful students of these matters, and the media was only too happy to promote the “progressive” line that these “market failures” required new large scale government intervention. To borrow a basketball analogy, the events of the last decade shifted the “possession arrow” of public opinion away from favorable attitudes toward de-regulated markets. This opened the door to an onslaught of new regulation, starting with Sarbanes-Oxley, and continuing through Dodd-Frank, Obamacare, and the EPA’s drive to control our energy use on behalf of climate change.

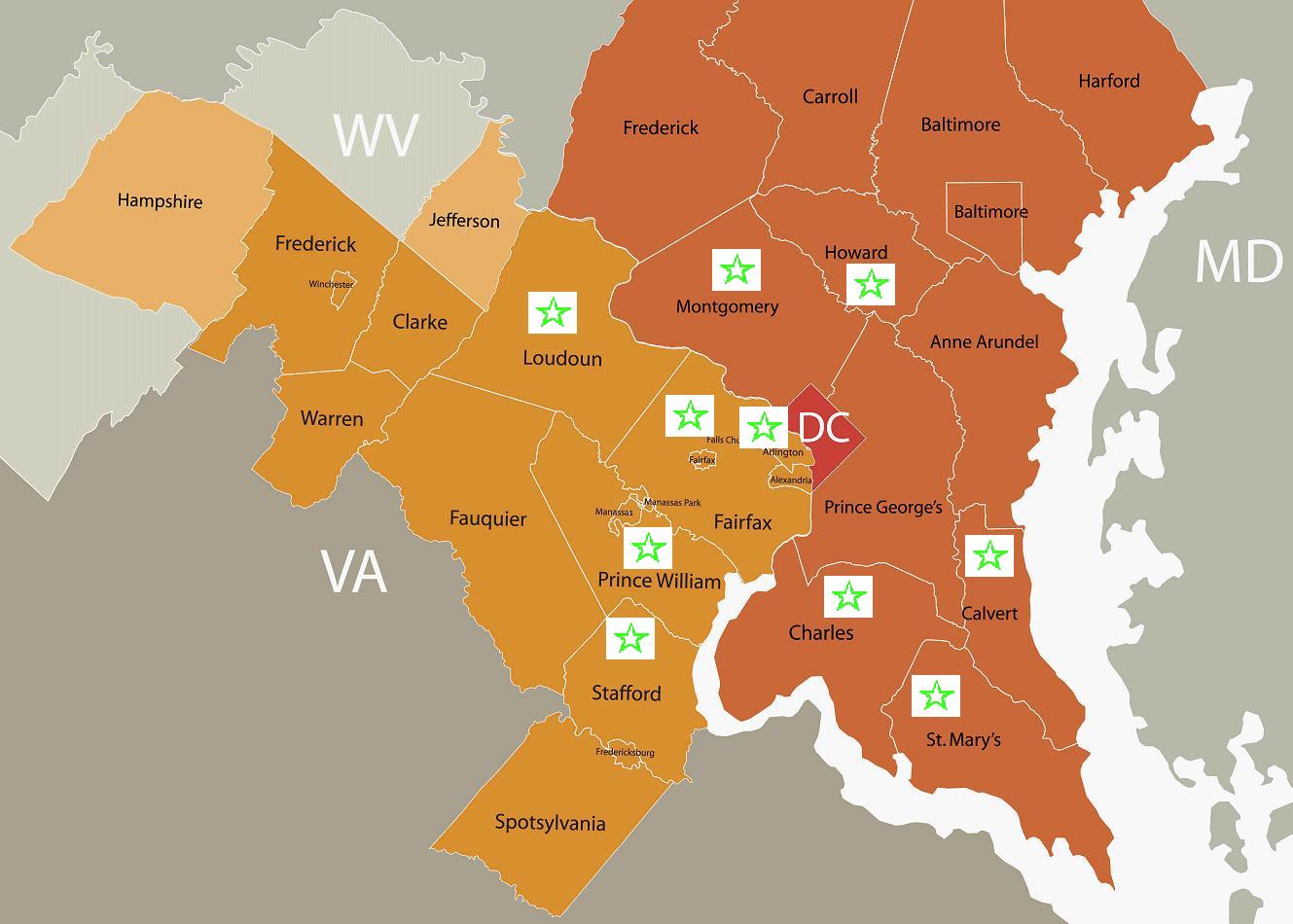

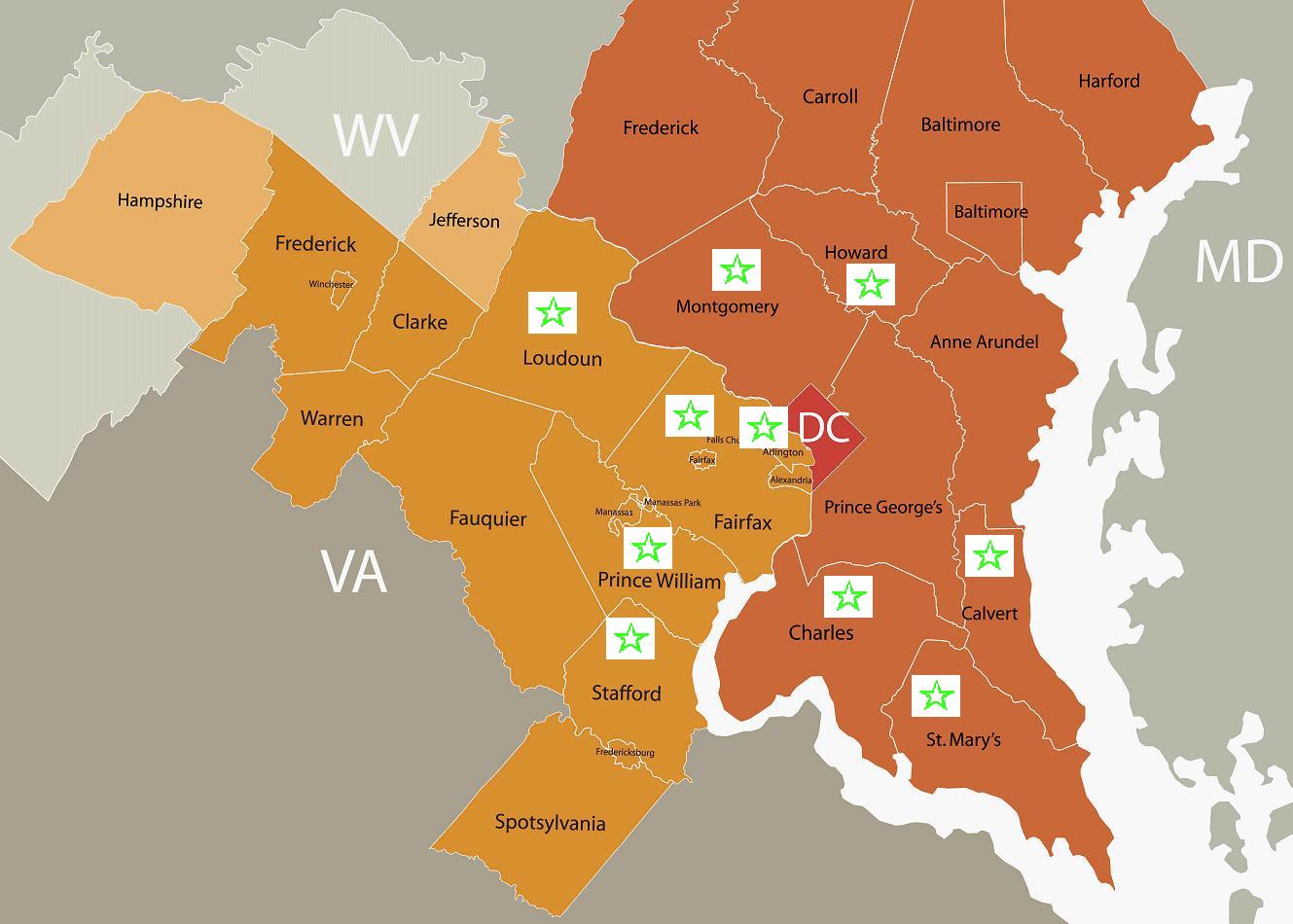

Once you have lost public sympathy, it is not easy to get back at a stroke. The spectacular collapse of Obamacare, along with recent poll findings showing an all-time high in the proportion of Americans who think government is a threat to their well-being, provide an opportunity to start fresh. It will not do simply to attack Obamacare’s failings and promising half-measures and “reform.” The moment cries out for leaders—potential presidents—who will speak in broad strokes about the superiority of free markets once again, patiently explaining that Obamacare is merely the culmination of 75 years of government interference in the health care marketplace that needs to be torn out root and branch. This critique can and should be extended beyond Obamacare, challenging once again the presumption that extending Washington’s reach is the answer to our discontents. (Start with pointing out the inherent corruption of the fact that eight of the ten richest counties are in the Washington area. This fact should be prominently advertised in every single speech.) This task requires a boldness and a clear grasp of the matter that has not been in evidence in Republican leaders for a long time.

The opportunity is breathtaking. The leader who figures this out will become the next Reagan.

The time is right for the next Reagan, however, I, for one, don't see that individual out there at this point in time, at least.

READ THIS AND GET MAD:

If you don’t believe me, check out this map showing that 10 of the 15 richest counties in America are the ones surrounding our nation’s imperial capital.

If you don’t believe me, check out this map showing that 10 of the 15 richest counties in America are the ones surrounding our nation’s imperial capital.

P.S.: Despite Republican claims of being the party of free markets and smaller government, the insider corruption of Washington is a bipartisan problem. Indeed, some of the sleaziest people in D.C. are Republicans.

P.S.: Despite Republican claims of being the party of free markets and smaller government, the insider corruption of Washington is a bipartisan problem. Indeed, some of the sleaziest people in D.C. are Republicans.

READ THIS AND GET MAD:

It’s a Very Merry Christmas for Washington Insiders

Last year, while writing about the corrupt and self-serving behavior at the IRS, I came up with a theorem that explains day-to-day behavior in Washington.

Simply stated, government is a racket that benefits the D.C. political elite by taking money from average people in America

I realize this is an unhappy topic to be discussing during the Christmas season, but the American people need to realize that they are being pillaged by the insiders that controlWashington and live fat and easy lives at our expense.

If you don’t believe me, check out this map showing that 10 of the 15 richest counties in America are the ones surrounding our nation’s imperial capital.

If you don’t believe me, check out this map showing that 10 of the 15 richest counties in America are the ones surrounding our nation’s imperial capital.

Who would have guessed that the wages of sin are so high?

D.C., itself, isn’t on the list. But that doesn’t mean there aren’t a lot of people living large inside the District.

Here are some interesting nuggets from a report in the Washington Business Journal:

D.C. residents are enjoying a personal income boom. The District’s total personal income in 2012 was $47.28 billion, or $74,733 for each of its 632,323 residents, according to the Office of the Chief Financial Officer’s Economic and Revenue Trends report for November. The U.S. average per capita personal income was $43,725.

Why is income in D.C. so much higher? Well, the lobbyists, politicians, bureaucrats, interest groups, contractors, and other insiders who dominate the city get much higher wages than people elsewhere in the country.

And they get far higher benefits:

In terms of pure wages, D.C., on a per capita basis, was 79 percent higher than the national average in 2012 — $36,974 to $20,656. …Employee benefits were 102 percent higher in D.C. than the U.S. average in 2012, $7,514 to $3,710. Proprietor’s income, 137 percent higher — $9,275 to $3,906. …The numbers suggest D.C. residents are living the high life.

Below is a chart from Zero Hedge comparing income growth for both D.C. and the nation as a whole over the last few decades. It uses median household income rather than total personal income, so the numbers don’t match up exactly with the numbers from above. Regardless, it shows how D.C. income grew faster than the rest of the nation during the Bush years, and then even more dramatically during the Obama years.

In other words, policies like TARP, the fake stimulus, and Obamacare have been very good for Washington’s ruling class.

Want some other examples of profitable Washington sleaze? Here are some excerpts fromRich Tucker’s column for Real Clear Policy:

The real place to park your money is in Washington, D.C. That’s because the way to get ahead isn’t to work hard or make things; it’s to lobby Washington for special privileges. Look no further than the sweet deal the sugar industry gets. It’s spent about $50 million on federal campaign donations over the last five years. So that would average out to $10 million per year. Last year alone, the federal government spent $278 million on direct expenditures to sugar companies. That’s a great return on investment.

Big Corn may get an even better deal than Big Sugar:

Until 2012, the federal government provided generous tax credits to refiners that blended ethanol into gasoline. In 2011 alone, Washington spent $6 billion on this credit. The federal government also maintains tariffs (54 cents per gallon) to keep out foreign ethanol, and it mandates that tens of billions of gallons of ethanol be blended into the American gasoline supply. Nothing like a federal mandate to create demand for your product. How much would you pay for billions of dollars worth of largesse? Well, the ethanol industry got a steep discount. In 2012, opensecrets.org says, the American Coalition for Ethanol spent $212,216 on lobbying.

Rich warns that the United States is sliding in the wrong direction:

What makes Washington especially profitable is that its only products are the laws, rules, and regulations that it has the power to force everyone else to follow. …[W]e seem to be sliding toward what the authors term “extractive” institutions. That means government [is] using its power to benefit a handful of influential individuals at the expense of everyone else.

And let’s not forget that some people are getting very rich from Obamacare while the rest of us lose our insurance or pay higher prices.

This Reason TV interview with Andrew Ferguson explains that there is a huge shadow work force of contractors, consultants, and lobbyists who have their snouts buried deeply in the public trough:

I particularly like his common sense explanation that Washington’s wealth comes at the expense of everyone else. The politicians seize our money at the point of a gun (or simply print more of it) to finance an opulent imperial city.

So if you’re having a hard time making ends meet, remember that you should blame the crowd in Washington.

P.S.: Despite Republican claims of being the party of free markets and smaller government, the insider corruption of Washington is a bipartisan problem. Indeed, some of the sleaziest people in D.C. are Republicans.

P.S.: Despite Republican claims of being the party of free markets and smaller government, the insider corruption of Washington is a bipartisan problem. Indeed, some of the sleaziest people in D.C. are Republicans.

P.P.S.: Though scandals such as Solyndra show that Obama certainly knows how to play the game.

P.P.P.S.: Making government smaller is the only way to reduce the Washington problem of corrupt fat cats.